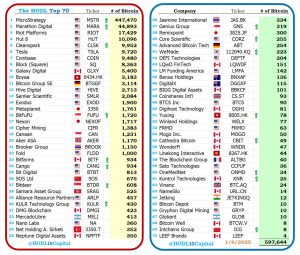

Public Companies Holding Bitcoin (BTC) on their balance sheets

With 2024 coming to an end, it’s important to the note progress among companies holding BTC within their balance sheets. Microstrategy is leading the way with nine consecutive weeks of adding Bitcoin to their balance sheets as of this Monday, 1/6/2024. The Bitcoin ETFs together hold a combined total of over 1.1 million Bitcoin (BTC). As we continue through 2025 and potentially receive more regulatory clarity, we could likely see more companies acquiring this new asset. It could continue to diminish the supply on markets for purchase with Bitcoin (BTC) having a fixed total supply of 21 million.

Some of these strategies for corporations include exposure to Bitcoin on their balance sheets, reusable energy with some Bitcoin mining use-cases (such as using flared gas as energy to power some mining operations), and hedging against current market downturns (compared to the other commodities such as gold). Now companies have even started to offer Bitcoin loans for real estate transactions. Below, we list some of the publicly traded companies currently holding Bitcoin (BTC) on their balance sheets. With a total of 591,726 BTC for the public companies alone

(Credit to Image HODL15Capital 1/6/2025 on X)