Digital Asset Adoption

The adoption and use of digital assets and cryptocurrency has surged exponentially in the last few years, with global ownership rates reaching an estimated 420 million by 2023 according to a report last fall. Although 420 million users represents only 5.2% of the global population, when one considers that number was only 100 million in 2020, it’s impossible to ignore the growth this industry has seen. Beyond individual investors, financial institutions and government integration of digital assets has contributed to pulling the industry out of its niche market and into the mainstream. Transaction volumes reflect this increase, with $10 trillion worth of on-chain activity recorded in 2022 alone.

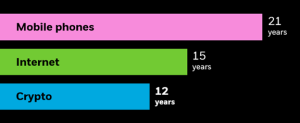

Just this week, BlackRock released visuals to share this narrative and examine digital asset growth against other revolutionary technologies like the internet and cellphones. When compared to the adoption of the internet and cellphones, digital assets, and the accompanying technology, are quickly outpacing its predecessors. The internet expansion exhibited an increase from 130 million users in 1995 to 1 billion by 2005. This held true for the cell phone, reaching over 7 billion subscriptions by 2015. In contrast, digital asset and cryptocurrency adoption has gone up 320 million in only 3 years. At its current rate, digital asset adoption is predicted to exceed 1 billion users by 2030, matching the internet’s explosive growth phase.

A few of the driving forces behind this trend are global accessibility of digital platforms and financial utility, especially in regions where economic insecurity, hyperinflation, or banking infrastructure is inadequate. If you own a cellphone, you can access the digital asset economy. Yet, despite the ease with which technology allows people access to digital assets, sustaining this momentum will require overcoming several challenges.

Regulatory uncertainty continues to disrupt industry expansion in developed economies. Additionally, issues such as price volatility, scalability, and security continue to be concerns. Despite these obstacles, cryptocurrencies and digital assets offer unique solutions to modern financial problems. If these challenges can be addressed, this industry will have the potential to achieve widespread adoption at a pace rivaling, or even outpacing, that of the internet and cellphone.

The first cellular mobile phone was used in 1973. Source: NPR, Our World in Data. January 1, 1983, is considered the official birthday of the internet. Source: University System of Georgia, Our World in Data. Initial price of bitcoin set in 2010.

Source Image: Bloomberg, Cambridge Center for Alternative Finance, Crypto.com.